Your small business is constantly exposed to a heap of risks and liabilities. Understanding the differences between types of insurance for small business — such as General Liability insurance, Business Owners Policies, and Professional Liability insurance — can help ensure you’re adequately protected against the dangers and perils that threaten your business.

It’s not always possible to totally avoid every risk faced by your business. Even if you’re adamant about following every OSHA guideline or producing impeccable work, situations occur in which your business may be held liable for a negative incident that takes place.

Unless you’re covered by the right types of insurance for small businesses.

The importance of insurance for small businesses

Every small business is exposed to a host of perils and legal liabilities. These risks occur as a result of:

- Business activities on your premises

- Your products

- Ongoing business operations

- Finished and completed work

- Wrongful acts that take place in the course and scope of your profession

In other words, dangers lurk seemingly everywhere when you’re running a small business. One unfortunate incident — whether it be a result of random misfortune, an oversight, or a mistake — may lead to devastating consequences for your business.

Claims made against your business may be costly. Between mounting a legal defense and paying any subsequent settlement or judgment, your business may end up on the hook for potentially millions of dollars.

And not every small business is insured against the risks that threaten it. In fact, according to a 2018 study by FreshBooks, only 60 percent of small business owners have small business insurance. Worse, only 49 percent of those business owners believe they’re properly insured.

Understanding the different types of insurance for small businesses helps ensure your business is properly insured and protected against the many risks it faces.

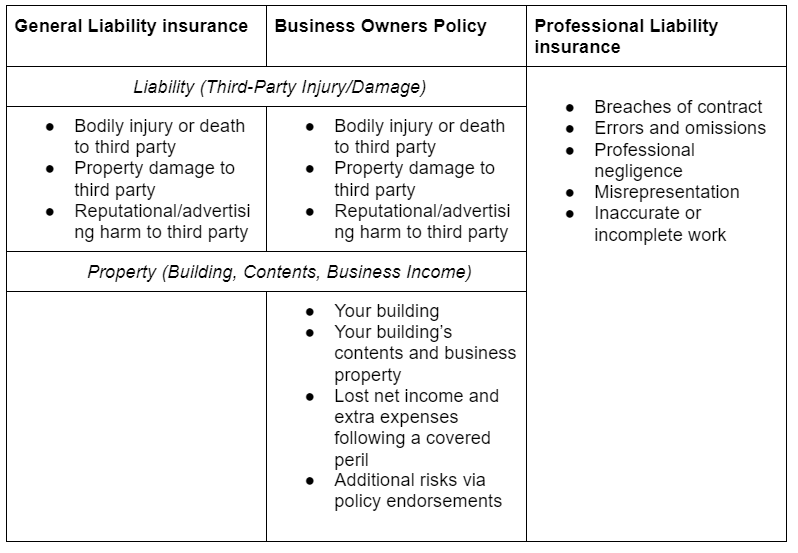

Business Owners Policy and General Liability insurance

Commercial General Liability insurance is the most basic insurance for small businesses. GL insurance protects your business from claims of damage done to a third party — your customer or client — including:

- Bodily injury or death

- Property damage

- Advertising or reputational harm (trademark infringement, copyright infringement, libel, and slander)

A Business Owners Policy, or BOP, is a comprehensive and robust form of insurance that includes all the protections of General Liability insurance. A BOP also protects your:

- Building

- Business personal property (building contents — your inventory, equipment, tools, furniture, etc.)

- Lost net income resulting from an interruption to your capacity or ability to service your customers or clients (including extra expenses incurred to keep your business operational)

BOPs may be further enhanced through the inclusion of endorsements, which expand coverage to better protect against the risks unique to your business, such as data breaches and water backups.

Professional Liability insurance

Where GL and BOP protect against physical risks, Professional Liability insurance for small businesses covers liabilities arising from errors, omissions, and other wrongful acts as a result of your profession.

Professional Liability insurance is especially necessary for small businesses that:

- Produce specific work on behalf of someone else

- Generate reports, make recommendations, or provide opinions

- Require some degree of skill, a license, or training to operate

Professional Liability insurance protects you from wrongful acts and economic damages not covered by GL insurance or a BOP, such as a failure to:

- Adhere to a contract or agreement

- Deliver a final product or service in a timely fashion

- Provide accurate or correct advice, product, or service

Depending on the industry, Professional Liability insurance may also be referred to as errors and omissions insurance, owing to its nature of protection against claims of mistakes, negligence, and oversights.

Comparing insurance for small businesses

The major differences between types of insurance for small businesses are in regards to who is covered how. Before requesting a quote, consider the coverage provided by each form of insurance for small businesses:

Your clients and customers often require you to have adequate insurance coverage. In other cases, you may be legally mandated or otherwise required (for example, by an industry regulator) to purchase a small business insurance policy.

Putting the right insurance policy or policies into place may help you put your customers’ doubts to rest while protecting your business from any perils that may come to pass.

Which type of insurance for small businesses is right for you?

Your business, like many others, likely faces a mix of liabilities and risks. By purchasing both a Business Owners Policy and Professional Liability insurance, you’ll protect against many of the common perils that threaten your business on a day-to-day basis, such as a:

- Customer tripping on a tool and sustaining an injury

- Refrigeration issue spoiling all your stock, or

- Missed deadline costing your client new business

With a Business Owners Policy and Professional Liability insurance, you can enjoy the peace-of-mind in knowing that many of the risks that threaten your business are covered, giving you more time to run your business and less time worrying.