Policyholder resources

Your insurance agent or broker is your first resource for any questions about coverages and your policy.

Need help selecting the right coverages?

Insurance is complex which is why we urge you to work with a licensed insurance agent or broker for personalized support about your unique coverage needs.

Policyholder popular questions

First, speak to your agent about the details of your loss. They can direct you on if your policy has coverage and if you should report a claim. They can also help you report a claim. You can report a claim by logging into your Policyholder Account. Then select the Report a Claim button to go through the reporting process. Our team will reach out in around two business days.

Please first contact your insurance agent to add an additional insured. If you need to make the request, note that all requests must come in writing, we cannot process via chat or phone. For fastest resolution, please complete this form. Please include the additional insureds: Name, Address, and relationship to PolicyHolder.

As a business owner and Coterie Insurance policyholder, you do not have access to log into our Dashboard. If you have an agent, please contact them for support. Or if you need assistance with your policy, reach us via support chat or phone.

You can easily update your payment method by going to our Billing Center.

If a payment fails, our system will attempt to pull automatically within a 10-day period.

To update your credit card information, log into the Billing Center.

Day of payment (i.e., 01/01/2023)

3 days after (i.e., 01/04/2023)

3 days after that (i.e., 01/07/2023)

3 days after that (i.e., 01/10/2023)

As long as the card on file is the correct card, the payment will be processed within that 10-day period. We cannot manually charge the card within this period. If you are beyond the 10-day window, you will need to make your payment here or call us.

The following changes will result in a new policy being issued to you and your business:

To make these updates, please use our Policy Change form.

Please reach out to your agent to discuss your coverage needs. You can use this form if you wish to cancel or non-renew your policy with us.

Insurance is complex which is why we recommend always working with a licensed insurance agent or broker to understand what coverages you need.

General Liability policies do not include building or personal property coverage. You would need a business owners policy (BOP). A BOP includes General Liability as well as Building and Personal Property coverage.

We require each business location to have its own policy. i.e. One policy for each address from which the business operates.

Go to our Find an Agent page, enter your ZIP code, and connect with a licensed insurance expert that can work with Coterie to assist you in updating your policy.

The following documents are for your use. If you don’t see something that you think would be beneficial to supporting you or your small business, please reach out to support@coterieinsurance.com.

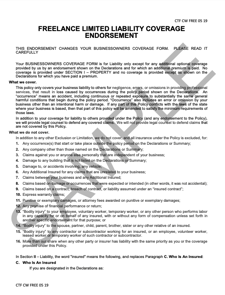

Sample of our GL Base Policy

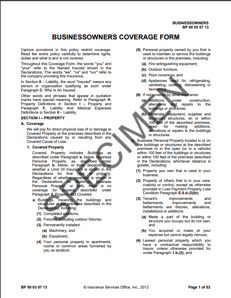

Sample of our BOP Base Policy

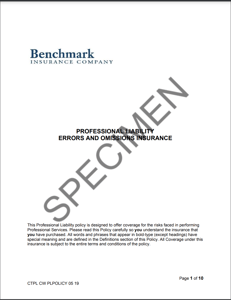

Sample of our PL Base Policy

Get answers, fast.

Top Questions We Get Asked

What You Need to Know About Actual Replacement Cost Value

Understand Your Business Certificate of Insurance

Protect your business.

General Liability Insurance

Commercial General Liability insurance protects your business from liability arising from claims of damage or injury. Often, General Liability insurance is required by landlords, financial institutions, industry regulations, or even your clients.

Business Owners Policies

BOPs generally make sense for small businesses based outside the home or businesses with equipment and property to protect. A Business Owners Policy will provide business income coverage.