As a freelancer, you probably get asked for a Certificate of Insurance all the time. But you’re likely wondering, “what is a business insurance certificate and why do I need it?” This article will tell you everything you need to know about Certificates of Insurance.

What is a business insurance certificate?

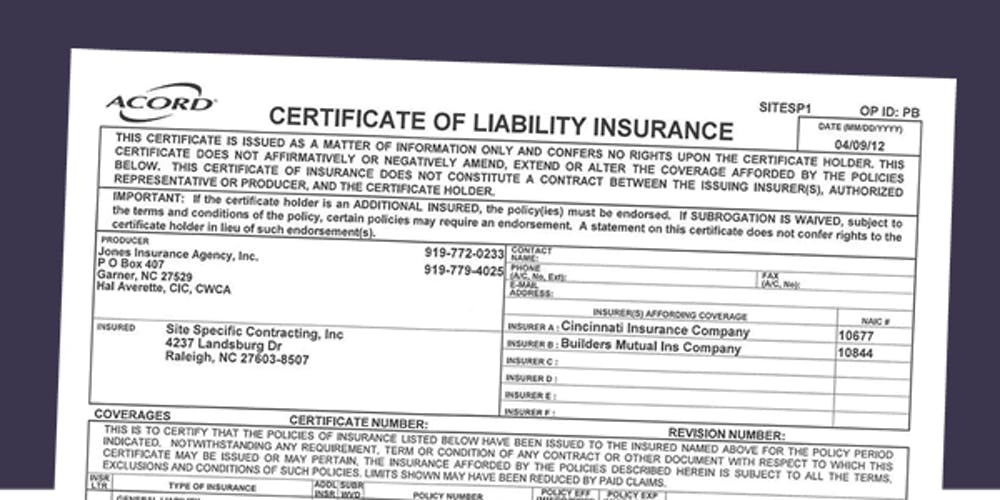

A Certificate of Insurance (COI) or business insurance certificate is a document that insurance companies use to show proof of your insurance coverage to third parties. The official name of the form that is most commonly used is the Acord 25 form. This form displays policyholder and insurance company information about any commercial liability insurance that you have in place. Including (but not always limited to); General Liability coverage, Auto Liability Coverage, Umbrella Liability Coverage, Workers’ Compensation, and Professional Liability Coverage.

Funny enough though, a COI is not a legally binding document. It’s merely a tool that insurance companies use to provide proof of coverage to relevant parties. It is similar to a receipt. A COI is just a reference or inventory of your insurance. As such, a COI does not actually prove that you have insurance. The only way a company can truly verify that coverage is in place is to contact the issuing company directly, using the information on your COI.

A COI could be out of date, have incorrect information on it, show that you don’t have the requisite coverage needed, or just simply be fraudulent. Making sure that you have an accurate and up-to-date COI is important because if you knowingly produce an invalid or fraudulent COI you could be guilty of insurance fraud.

Why do I need a business insurance certificate?

At this point, you may be asking “why do they need proof of my insurance?” Put simply; accidents happen, people mess up, and mistakes often cost money. Your clients know this. They want assurance that if something bad does happen, they are protected. At the end of the day, it’s all about protecting themselves from financial harm.

Having insurance makes you look more responsible and more attractive to work with. People are much more interested in working with someone who has all of their ducks in a row.

What exactly is a Certificate Holder? And why does my client want to be one?

If someone wants to be listed as a business insurance certificate holder, that simply means that they want to keep tabs on your insurance and make sure that they are protected from any excess liability. Companies usually have set requirements for the contractors that they work with and require proof of coverage before work begins on the project.

When a company or individual is listed as the certificate holder, they will be notified if your policy is canceled for any reason. Your certificate holders want to make sure that you have and keep your insurance in force throughout the entirety of your contract, not just in the beginning.

So enough with the insurance speak, what does my COI need to look like?

Whenever you request a COI from your insurance company, make sure that you follow these rules:

Rule #1: Get your name right.

- If your business is under your name, make sure that YOUR name is listed as the policyholder.

- If your business is under an LLC, make sure that the name of the LLC is listed as the policyholder.

- If you are working under a DBA, either your personal name or DBA needs to be listed as the policyholder.

Rule #2: Make sure your Certificate Holders and Additional Insureds are properly identified.

- Make sure their names are spelled correctly and that their contact information is accurate as well.

- If your certificate holder asks to also be listed as additionally insured on your policy, make sure that you call your insurance company to officially add them as additional insured. Then make sure your client’s name is in the Certificate Holder box and that they are either listed as additionally insured in the Description of Operations or that the “ADDL INSD” box is marked with an “X” or “Y”.

- If you have any questions about how they need to be listed, the best thing to do is ask the company requesting the insurance how they want to be listed. Do they want an address listed? A phone number? email? If you ask, they will usually send exactly what they need to see, and you can forward that to your insurance company.

Rule #3: Make sure your limits are correct and your coverage is active.

- Double-check that your policy has not expired! The Policy Expiration date listed should be sometime in the future

- Make sure that your liability limits and other coverages are up to your certificate holders’ standards. Your certificate holders have very specific insurance requirements; know what they are and make sure that your coverage meets them.

For more information, find a breakdown of a COI below. This breakdown expands upon the individual components that make up a COI using the ACORD 25 as an example.

Certificate of Insurance Visual Breakdown

- Certificate Date: This refers to the date the Certificate was created.

- Producer: This section contains information for the insurance agency or company that issued the certificate.

- Producer Contact Info: This section includes an agent or company name, agency phone and/or fax number, and agency email address. If the certificate needs additional information added or removed or you have questions about the coverage you can use this information to contact the producer.

- Insured: This includes the legal name and mailing address of the policyholder. This can be an individual or a business name.

- Insurers Affording Coverage: This section includes information about the insurance companies that are providing coverage on the policies listed below. The reason for several rows in this section is that a customer can have different coverage with different carriers. For example, a customer can have General Liability coverage with one company and have Workers Comp with a completely different carrier.

undefined

- Type of Insurance: This column is dedicated to the type of insurance coverage that a customer has purchased

- Additional Insured: This section is used to indicate if the certificate holder is also additionally insured on the corresponding policy. This box will be marked with an “X” or a “Y” if the certificate holder is named as an additional insured. If the certificate holder is not named as an additional insured, then this box will remain empty or contain “N” or “N/A.” All of these Insurance coverages are formatted in their own unique row to be filled out with the proper policy information.

- Subrogation Waiver: This box details whether the right of subrogation has been waived for additional insureds. If it has, the box will be marked with “X” or “Y.”

- Policy Number: Policy numbers for the purchased policies are listed in this section of the certificate. The policy number is a unique id for each policy.

- Policy Effective Date and Expiration Date: The Policy Effective date is when the insurance coverage started. The Policy Expiration date is when the policy and the underlying coverage ends.

- Limits: This section displays the individual limits for each policy coverage.

- Description of Operations and Other Remarks: This section includes details such as operations, locations, and/or vehicles. It can also include language about additional insured or waiver of subrogation. This is also a good place to put any specific information about the policy or coverage. If a certificate holder wants to see any specific language this would be the place to put it.

- Certificate Holder: If your client asks to be listed as a certificate holder, their business’ legal name and address will be displayed in this box. If there are multiple certificate holders, each certificate holder will usually get their own copy of the certificate showing that they are a certificate holder.

- Authorized Representative: This is where an authorized representative from your insurance provider, typically the agent or whoever created the certificate will sign.

Understanding and obtaining a business insurance certificate (COI) is crucial for freelancers and contractors. A COI serves as proof of insurance coverage and provides reassurance to clients that they are protected from financial harm. It showcases your professionalism and responsible approach to business. Remember, a well-managed COI process can help protect your business and foster trust with clients. For more assistance with insurance, Find an Agent to help you with your unique insurance needs.