According to the IBIS World Landscaping Services Industry Report, the landscape services industry in the U.S. had a market size of $129 billion in 2022. The industry employs more than 1.2 million people and currently represents 633,481 landscaping service businesses and 633,481 landscaping service businesses. It is likely that many of these businesses operate in your community. As an expert insurance professional, how can you write insurance for landscapers and retain these types of businesses for your agency?

Here are some ways that you can help landscaper and lawn care businesses understand what insurance coverages they should consider:

Conduct a Risk Assessment

The first step in determining the appropriate insurance coverage for a landscaping business is to conduct a risk assessment. This involves evaluating the various exposures that the business faces, such as property damage, auto accidents, employee injuries, liability claims, environmental risks, and cyber threats. By identifying these risks, insurance agents can recommend the right insurance policies to protect the business against them.

Explain Insurance Coverage Options

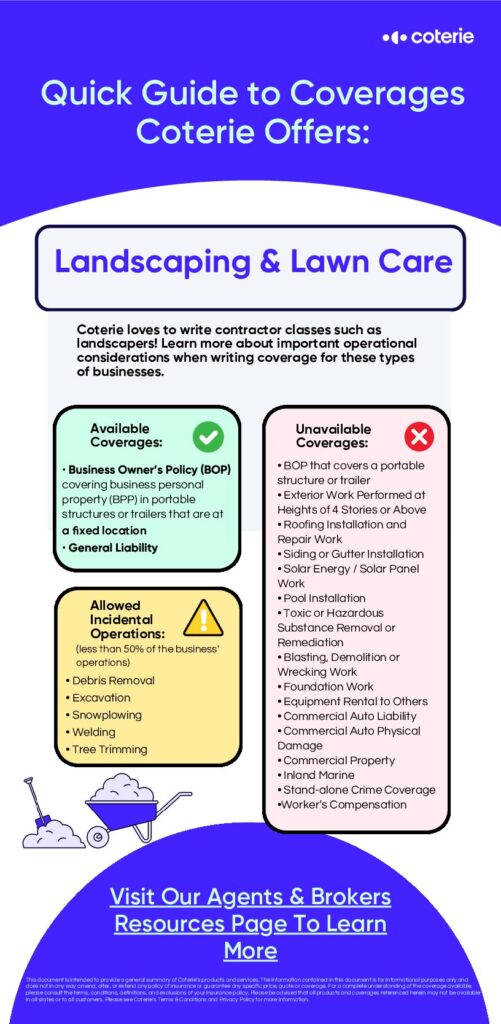

Once the risks have been identified, insurance agents can explain the various insurance coverage options available to their landscaping clients. For example, a commercial property insurance policy can help cover the cost of repairing or replacing damaged property, such as tools, equipment, and buildings. General liability insurance can protect against third-party claims for bodily injury or property damage caused by the business.

Customize Coverage to the Business

Every landscaping business is unique, and insurance coverage should be customized to meet the specific needs of each business. You can work with their landscaping clients to tailor coverage to their individual businesses, ensuring that all potential risks are adequately covered.

Provide Ongoing Support

Insurance needs can change over time as businesses grow and evolve. Be sure to provide ongoing support to landscaping clients, regularly reviewing their insurance coverage and recommending adjustments as needed to ensure that they are always properly protected. Offer our landscaping business safety tips as an educational resource.

As an insurance agent, you play a critical role in helping landscaping clients navigate the complex world of insurance. By conducting risk assessments, explaining coverage options, customizing coverage to the business, and providing ongoing support, you can ensure that your clients have the right insurance coverage to protect against potential losses. Get started writing more insurance for landscapers and lawn care services with Coterie today!