Insurance is a method of sharing risk, in which each member of a group pays a small amount of money each month or year in return for protection from larger and unexpected financial perils.

But how do small business insurance and in turn, business insurance services work?

Small business insurance services are similar to other types of insurance. Policyholders pay a relatively small premium in exchange for protection from financial risks they could not easily cover on their own.

A crucial part of calculating those premiums, or rates, is a process called classification. Classification allows insurance companies, like Coterie Insurance, to organize businesses into groups based on risk, or the likelihood a business will file a claim. This effectively helps the businesses within a class share risks with one another.

Classifying small business insurance services

Typically, insurance companies ask four basic questions to classify your business and calculate a rate for a small business insurance policy.

Coterie Insurance employs an automated underwriting engine that calculates risk simply by inputting two pieces of information: business name and address. Our system then pulls existing data on the risk, saving time and manual entry.

1. What does your business do?

Your type of business and the industry in which it operates helps insurance companies assess your risk exposure. For example, a business that operates a storefront faces different risks than one that operates out of a home.

Insurance companies also consider the types of customers or clients they serve. A residential plumber experiences dangers unique to a residential setting vs. those faced by a commercial plumber.

The number of people you employ is also important when classifying your business. A business with multiple employees may be considered more at-risk than a sole proprietorship or one that outsources work.

2. How large is your business?

The size of your business can impact the amount or degree of risk to which it is exposed. Each customer or client you service represents another potential liability; even though an expansive customer base may directly tie into higher income, you also have more exposure than a smaller business that provides the same service.

For example, a solo freelancer is exposed to fewer and less complex perils than a multi-department firm or agency, even if both businesses share the same types of risk.

Because the freelancer is one person, he or she is limited by a finite amount of work — and accompanying risk. However, multiply that risk by the number of employees that perform the same work as the freelancer, and the exposure balloons.

3. Where does your business operate?

The location of your business, including where it operates, is also used to determine classification and small business insurance rate.

Rates differ not only by state, but by exact locations, too. Not only may a mechanic in California pay a different rate than one in Ohio, a coffee shop owner in Columbus, Ohio may pay a different rate than one a few miles away with completely different risk characteristics.

Such differences exist because of varying:

- Specific risk attributes (proximity to fire hydrants, rivers, etc.)

- claim experiences,

- product offering

- building and zoning codes,

- laws and litigation,

- natural disasters,

- weather and temperature patterns, and

- other factors.

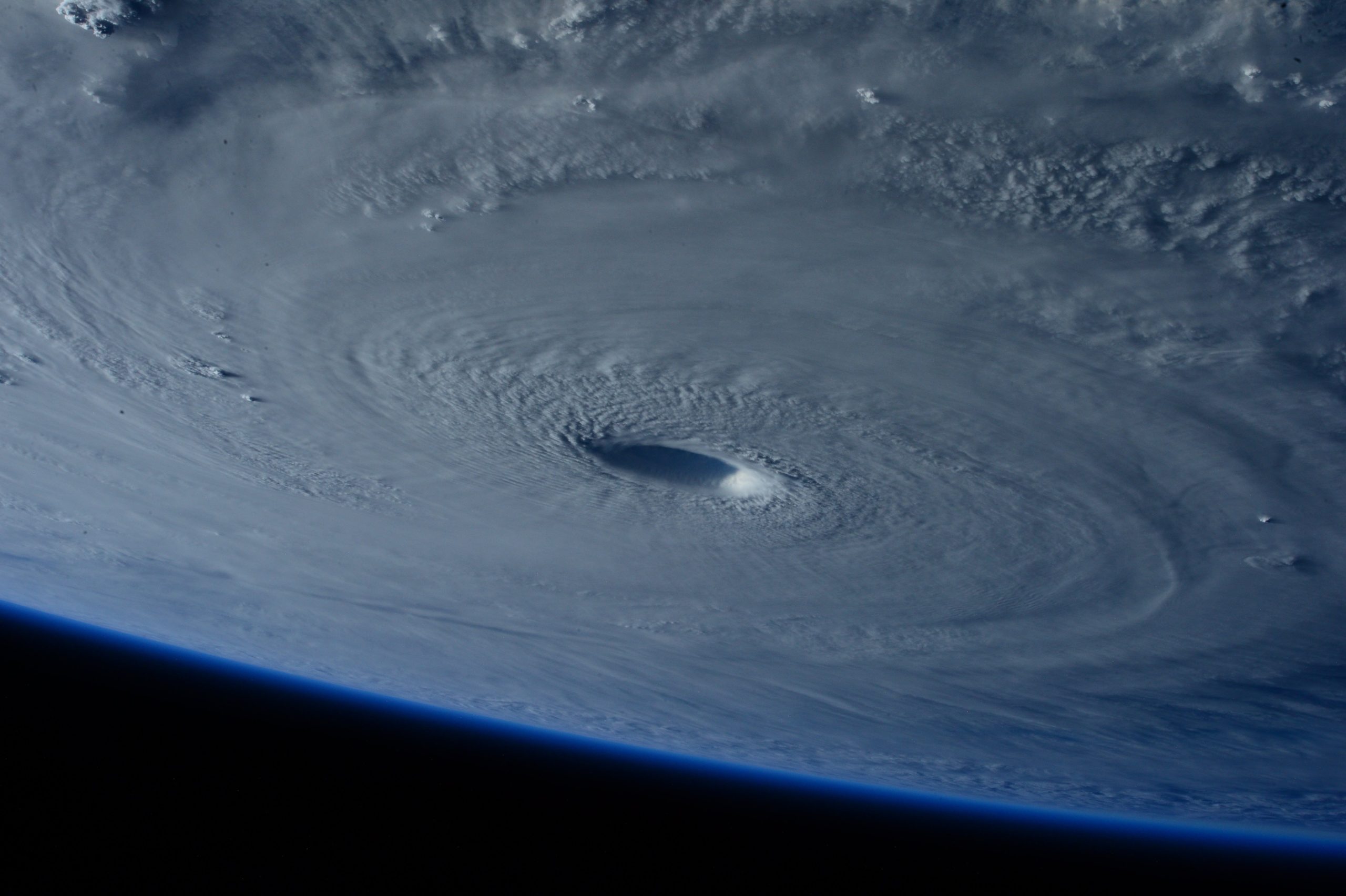

Risk factors vary greatly. For example, a business located in tornado alley is endangered by a different set of risks than one on the San Andreas Fault Line.

Consider, too, the number of claims filed in one area compared to another. Businesses based in urban centers may be more likely to file claims compared to a business serving a rural community.

4. How good are you at what you do?

Insurance companies take into account your business’s experience, history, and longevity when classifying it. A company in business for 20 years may be deemed less risky than a new business without a proven track record.

The claims history of a business is also examined during classification. A business with numerous or repeated claims over a short or recent timeframe is riskier than a company with little to no recent claims.

As such, a business that performs quality work on a consistent basis, with little to no claims history, will typically pay less for insurance than one that’s new or likely to operate in a more shoddy or questionable manner.

Using classification to determine your rate

When your agent helps you get a quote for small business insurance services, details about your business will be analyzed, including your requested coverage limits, to provide you with a rate for a policy.

Coterie recommends you work with a licensed insurance agent or broker to better understand what you’re purchasing and ensure the coverage fits your business.

From there, you can quickly and easily purchase coverage, providing peace of mind to yourself, your team, and your customers. No longer will you be solely responsible for overcoming a risk that could leave your business bankrupt or financially crippled; by purchasing insurance coverage, those risks are split with other businesses within your class, reducing everyone’s out-of-pocket exposure.