Hurricanes are a part of life for many in coastal regions of the United States. While damage can be devastating, there are steps small business owners can take to help prepare for a hurricane. As an insurance agent, take action to help your small business clients that might be at risk for hurricanes prepare and build trusted relationships as a resource. In this blog, learn key hurricane preparedness tips for small businesses.

Planning

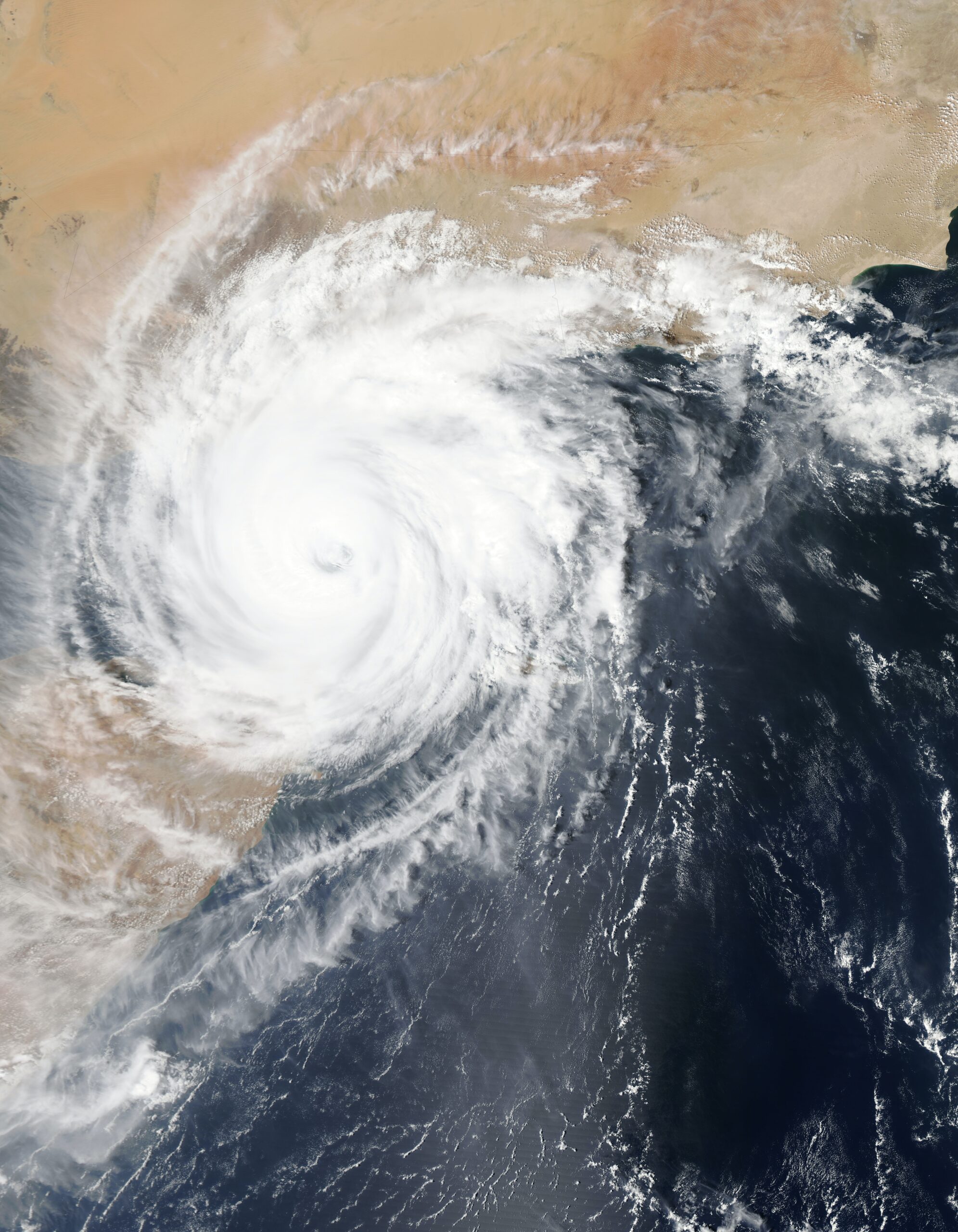

Commercial properties suffer significant losses because of hurricanes every year. According to the National Oceanic and Atmospheric Administration, the total approximate cost of damages from weather and climate disasters in the U.S. has been $2.6 trillion (from 1980 – August 2023). In particular, hurricane-related property damage and loss can stem from:

Wind damage—Hurricane winds can exceed 100 mph and result in extensive property damage.

Water damage—Rain and storm surges—tidal waves that are pushed toward the shore during a storm—can cause damage to property and equipment and jeopardize the health and safety of occupants.

Business disruptions—A hurricane’s short- and long-term physical and economic impacts can make it difficult for businesses to resume operations.

Research from risk modeling firms suggests hurricanes are increasing in frequency and severity, making it more important than ever for business owners to be prepared for the far-reaching effects of these tropical storms.

Speak with your clients about what their current policy covers and does not cover as it relates to hurricanes. Some policies may exclude flooding, while other policies may provide coverage for business continuity.

Help your clients ensure they have the proper coverage for hurricane-related damages. Work with them to complete a risk assessment to assess the business’s risk for hurricane damage and recommend ways to mitigate that risk.

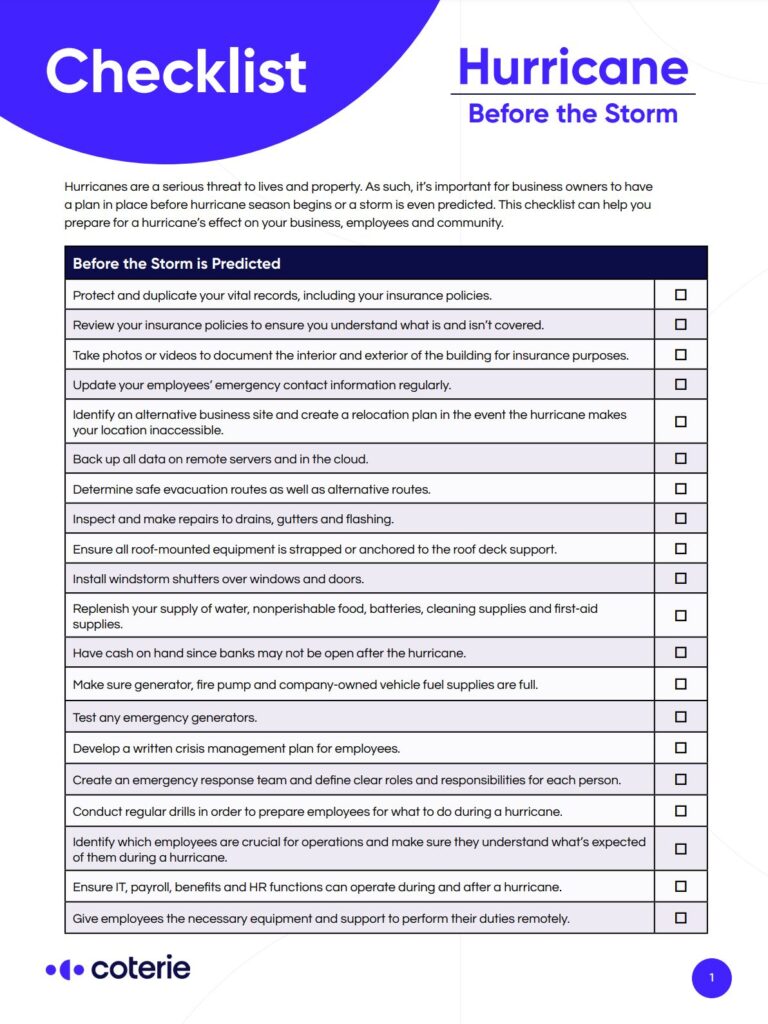

You can also share information on what to do before, during and after a hurricane to minimize damage and ensure safety.

Take time to create a disaster plan with your clients. As an agent, you can help the business create a disaster plan that outlines procedures for evacuating employees, protecting equipment and inventory, and communicating with customers.

Hurricane Related Coverage

Hurricanes can cause devastating damage to commercial properties, and it’s essential to have adequate insurance coverage before a storm hits. Wind, hurricanes, and hail are basic covered perils in many insurance policies, but it’s common for some carriers to exclude wind in places that are prone to catastrophic storm loss, such as coastal areas.

- Flood insurance—Flood insurance covers losses directly caused by flooding and can include building and contents coverage.

- Windstorm insurance—If the primary property policy doesn’t cover wind, encourage policyholders to obtain Windstorm insurance which protects them from property damage caused by gales, winds, and hail.

- Sewer backup insurance—Hurricanes can wreak havoc on sewer systems. Sewer backup coverage can protect properties from losses caused by a discharge of water or waterborne material from a sewer, drain, or sump.

Also help your clients understand that while most commercial property policies cover debris removal costs, there may be limitations.

During and After the Storm

Coterie Insurance may issue a storm moratorium during an active tropical storm or hurricane. This means we stop selling new coverage in the projected path of the storm; this includes property coverage and endorsements. We typically still sell general liability policies and there is no impact on renewals.

As an agent, you can provide a list of emergency resources, such as contractors and restoration services, that can help the business recover after a hurricane. Make sure to advise your clients not to return to their business until local officials have declared it safe to enter.

Here are some other recommendations for your clients during the storm:

- Move personnel to safe locations.

- Secure all windows, doors, and outdoor objects or equipment.

- Give employees plenty of time to relocate.

- Stop nonessential operations 12 hours before impact.

- Communicate with employees and encourage them to take necessary precautions.

- Patrol the property to watch for roof leaks, pipe breakage or any fires.

- Monitor any equipment that must remain online.

- Turn off electrical switches during power failure.

More Information

Don’t wait for a storm to occur. Work with your small business clients to ensure proper coverage is in place to protect their property in the event of a hurricane. Share these hurricane preparedness tips for small businesses with your clients. For more preparedness advice and guidance, check out resources from the Small Business Administration.