Barbecue food stands and food trucks are a common sight at outdoor events, fairs, and festivals, and offer delicious food for customers on the go. As an insurance agent or broker, it is essential to understand the risks associated with these types of businesses and provide appropriate insurance coverage to protect them against potential losses. In this blog, we’ll discuss what to consider when writing insurance for barbecue food stands and food trucks.

Barbecue food stands and food trucks are classified under the NAICS code for mobile food services. These businesses typically serve a limited menu consisting of sandwiches, salads, snacks, hot dogs, pretzels, specialty food items, and soft drinks. Some items are pre-packaged, while others are prepared to customer specifications. Condiments may be available, and limited seating may be provided for on-premises consumption. However, customers usually purchase items and consume them elsewhere.

What is the difference between a “Food Truck” and a “Mobile Food Stand”

A food truck is a motor vehicle, that has an engine and is licensed for use on public roads and thoroughfares. When not in use, it can be driven to another location and set up there.

A “Mobile Food Stand” can be one of several different things, however, it is not a vehicle. Kiosks, small portable buildings, catering trailers or carts, even BBQ pits mounted on trailers… all of these are mobile food stands, capable of being moved from one place to the other but not under their own power.

Barbecue food stands and food trucks may operate on a seasonal basis, and they can be free-standing or located within a larger operation such as an arena, department store, fair, office building, park, or stadium.

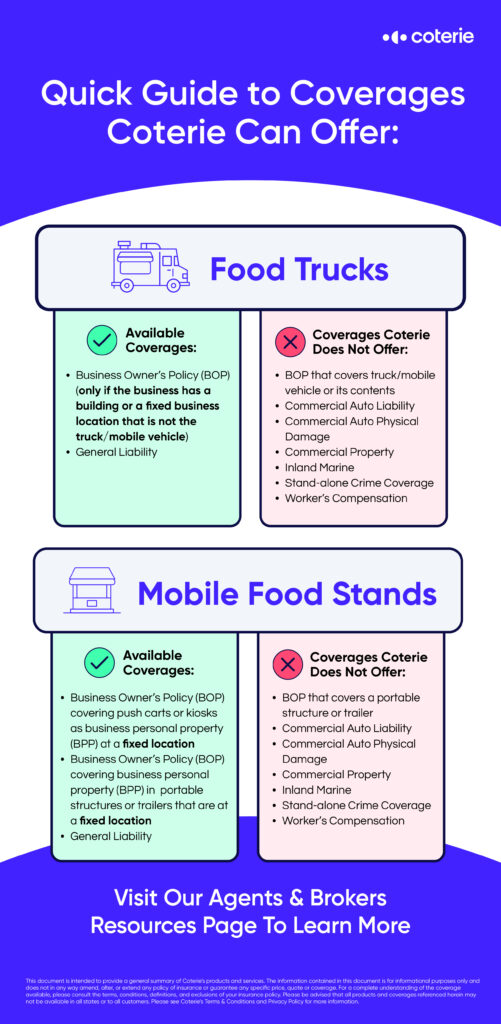

To protect barbecue food stands and food trucks against potential losses, insurance agents and brokers should consider the following types of coverage for Food Trucks and Food Stands:

- General Liability Insurance: General liability insurance provides coverage for bodily injury, property damage, and personal and advertising injury caused by the business’ operations. Since barbecue food stands and food trucks serve food, there is a high risk of food poisoning, contamination, and allergic reactions. Customers may also slip and fall, leading to bodily injury. General liability insurance can help protect the business against such risks. General liability coverage would protect the insured for injuries or damage caused by his food service (business) operations; however, this does not include the operation of the truck as a motor vehicle. Many municipalities require food truck operators to provide evidence of GL coverage in order to obtain a permit or operate the truck in certain areas. Again, general liability coverage does NOT cover the operation of the insured’s food truck or other commercial or personal vehicles.

- Property Insurance: Property insurance provides coverage for damage to the business property due to covered perils such as fire, theft, and vandalism. Since barbecue food stands and food trucks typically use electrical wiring, refrigeration units, cooking equipment, and heating and air conditioning systems, they are exposed to property risks. Wiring must be up to code, well-maintained, and adequate to support refrigeration units. Ammonia used in refrigeration units can explode. A system designed to detect leaks should be in place. Refrigeration equipment must be inspected and maintained on an ongoing basis. While cooking may be limited to microwave and toaster ovens, there may be grills or deep fat fryers which must be protected by automatic fire extinguishing protection, hoods, and filters over all cooking surfaces.

It is important to note that the property coverage Coterie provides under a business owners’ policy DOES NOT cover the actual food truck. If a food stand is not a vehicle but is still mobile, we do not provide property coverage to the structure itself either.

When it comes to Business Personal Property (BPP), Coterie can cover the contents in the truck, unless it is permanently located. Otherwise, the off-premises limits will cover those contents. Be sure to confirm that the off-premises limits under a BOP are sufficient for your client. (Note: any equipment permanently mounted in or on the truck should be included in the truck’s value and covered under the auto physical damage policy.)

*The following coverages are available with Coterie Insurance only if the business has a building or a fixed business location that is not the vehicle or mobile structure:

- Crime Coverage – This coverage is included in Coterie’s base Business Owners Policy (BOP)

- Money and Securities – This coverage is included in Coterie’s base BOP

- Employee Dishonesty – This coverage can be included in Coterie’s Silver, Gold, or Platinum endorsement packages available for a BOP policy.

With the month of May being National BBQ Month, it’s a great time to ensure that your clients in the mobile food services industry have the right insurance coverage in place. If you’re interested in writing insurance for barbecue food stands and food trucks, reach out to Coterie Insurance to learn more about our specialized insurance solutions. We’re here to help you provide the best possible coverage for your clients in this exciting and growing industry.