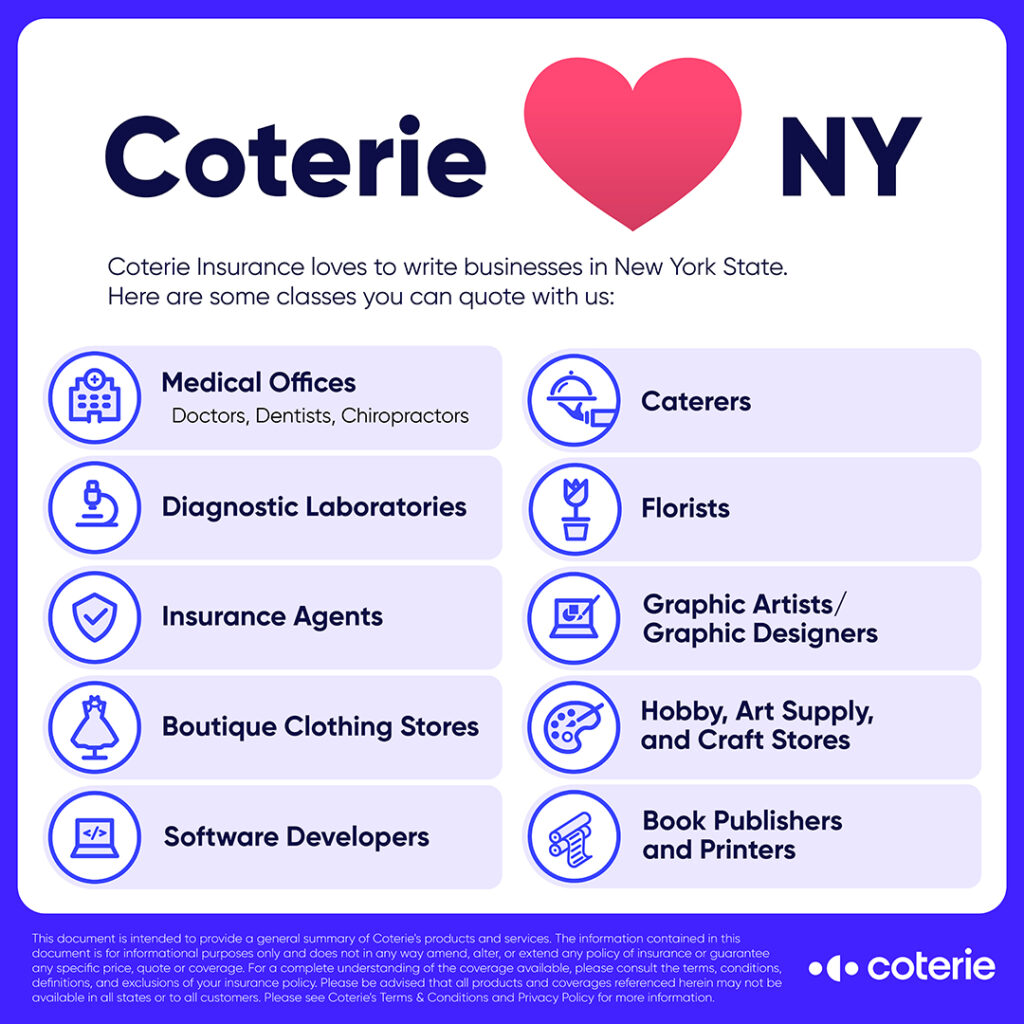

If you’re looking for small business insurance coverage in New York, you may have questions. What types of small business insurance policies should you consider to protect your New York small business? How much coverage do you need? What impacts the cost of small business insurance in New York?

You’ve got questions. And at Coterie Insurance, we’ve got answers. Below, we’ll discuss small business insurance coverages in New York that may apply to your business. We’ll also go over some of the factors that can affect how much you’ll pay for the insurance you need to protect your business.

What Small Business Insurance Coverage Is Available In New York?

- General liability and/or property insurance – General liability insurance protects you from liability for things like accidents at your business, like if a customer slips and falls. And property insurance covers damage to the building that you’re renting, as well as your equipment, supplies, retail inventory, and other property inside your store or business.

Almost all landlords in New York will require you to carry both general liability insurance and property insurance. These are often combined into a Building Owners Policy or BOP. Without these types of insurance, your business could be at risk if someone sues you, or if your property is damaged by vandalism, accidents, or a natural disaster. Coterie offers General Liability and BOP coverage in New York (Note that contractor classes are excluded from Coterie’s appetite in New York State).

- Professional liability insurance– This is also called “errors and omissions” insurance. This type of coverage protects you if a client sues you due to a mistake or negligence while providing professional services.

What Other Insurance Coverage Should I Consider?

- Workers’ compensation & disability insurance– New York law requires you to carry both workers’ compensation and disability insurance if you have any employees besides yourself. This includes full-time, part-time, and seasonal employees. If you have any employees at all, you must carry workers’ compensation and disability insurance to protect your employees from workplace injuries.

What Affects the Cost of Small Business Insurance In New York?

If you’re looking for New York small business insurance policies you may be wondering what will affect your rates, and how much you’ll pay. There are lots of things that can affect how much you’ll pay for coverage, including:

- Your industry and business risks – Generally speaking, you’ll have higher insurance costs if you operate in a high-risk business. For example, the risk of serious damage to a building due to an accident is lower if you operate a retail store, compared to operating a large factory.

- Number of employees/payroll size – For some types of insurance like workers’ compensation, insurance costs are partly determined by the number of employees you have, and how much you’re spending on payroll. In general, the larger your business, the more you’ll pay overall for insurance.

- Policy limits and deductibles – The more protection you get, the more you’ll pay. A $10 million property insurance policy will cost more than a $5 million property insurance policy, for example.

Your deductible, which is how much you’ll pay before insurance kicks in, also affects your rates. Generally speaking, higher deductibles mean you’ll pay lower monthly premiums, while lower deductibles will raise the monthly cost of small business insurance.

- Location – The physical location of your business is also taken into account for property insurance, liability insurance, and some other types of insurance. For example, if your business is located in an old building or in an area of New York with high crime rates, you’ll pay more for insurance.

This is just the tip of the iceberg. Many different factors can affect your insurance rates in New York, and every business is different. To make sure you get a great deal – and the coverage you need – it’s important to work with an experienced insurance agent.

Need New York Small Business Insurance? Find A Coterie Agent Today!

Small business insurance is essential for protecting your business in New York. And the best way to get the right coverage – at the right price – is to work with a reputable, knowledgeable insurance agent.

At Coterie Insurance, small business insurance is our specialty. And if you need general liability, property, or professional liability coverage for your business in New York, we’re here to help. Take a look at our licensed, expert insurance agents in New York, and take the first steps toward getting the coverage you need.