Artisan contractors (also known as trade contractors or specialty contractors) are those who specialize in a particular skill. Carpenters, plumbers, electricians, roofers, stone masons, and painters are all examples of artisan contractors that should consider purchasing general liability insurance.

Artisan contractors are not the same as general contractors (GCs). A general contractor will typically be in charge of a project, such as the construction of an office building or the renovation of a single-family home. The management of that project might involve the use of any number of artisan contractors or subcontractors, to perform different tasks that bring the project to completion. On smaller jobs, the general contractor may even perform some of the work themselves.

Many artisan contractors are considered subcontractors, which simply means they’re hired by another contractor to perform a job that lies within their area of expertise.

Why Do Artisan and Trade Contractors Need General Liability Insurance?

Artisan contractors need commercial general liability (CGL) insurance to protect themselves and their assets in case they are sued by someone (other than an employee). A CGL policy will typically provide coverage for bodily injury or property damage you cause to other parties or their property. Policy specifics will vary but will generally include coverage for situations like:

- A stone mason stacks some bricks on the sidewalk. While working on his project the bricks fall over into the middle of the sidewalk; the property owner comes out to walk his dog, trips over the bricks and falls and breaks his arm.

- A contractor installing a new exterior window falls off a ladder. While trying to slow his descent, he grabs at a nearby trellis and pulls it off the house, causing damage to both the trellis and the siding of the house.

- A landscaper using his commercial mower forgets to turn the blades off when rolling over a gravel driveway and propels rocks at his client’s building, breaking two glass windows.

It’s also important to understand any secondary or incidental operations artisan contractors might perform and whether or not Coterie Insurance covers those operations.

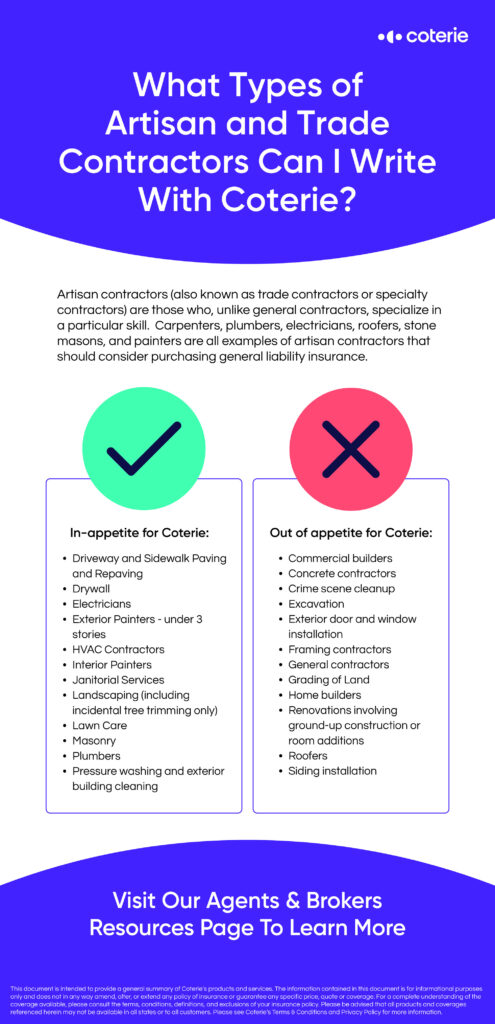

Learn more about which types of artisan and trade contractors you can write with Coterie Insurance:

Are you ready to write more general liability coverage for trade and artisan contractors? Sign up with Coterie to grow your book quickly and simply!