A certificate of insurance (COI), also known as a business insurance certificate, is a document used to show insurance coverage proof. The document is issued by an insurance company and typically shown to interested third parties.

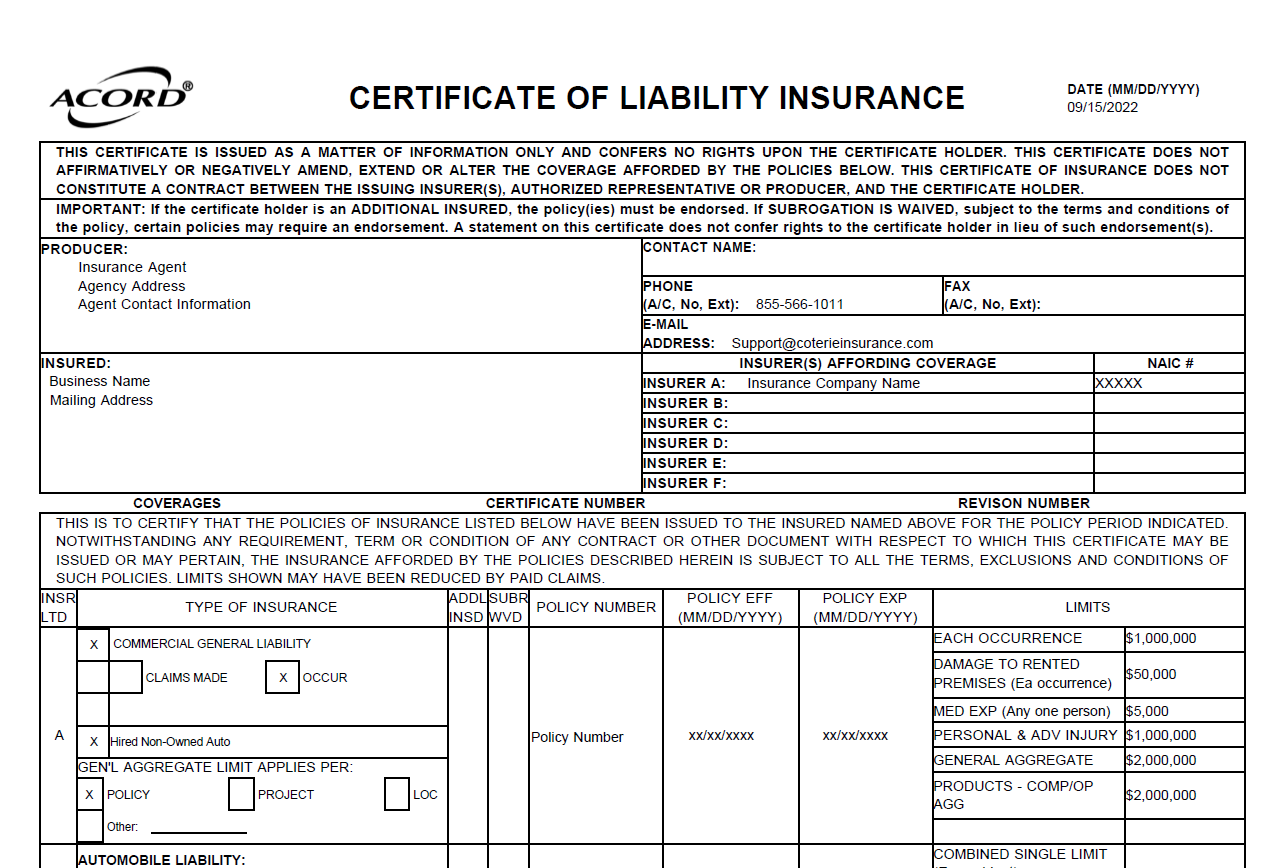

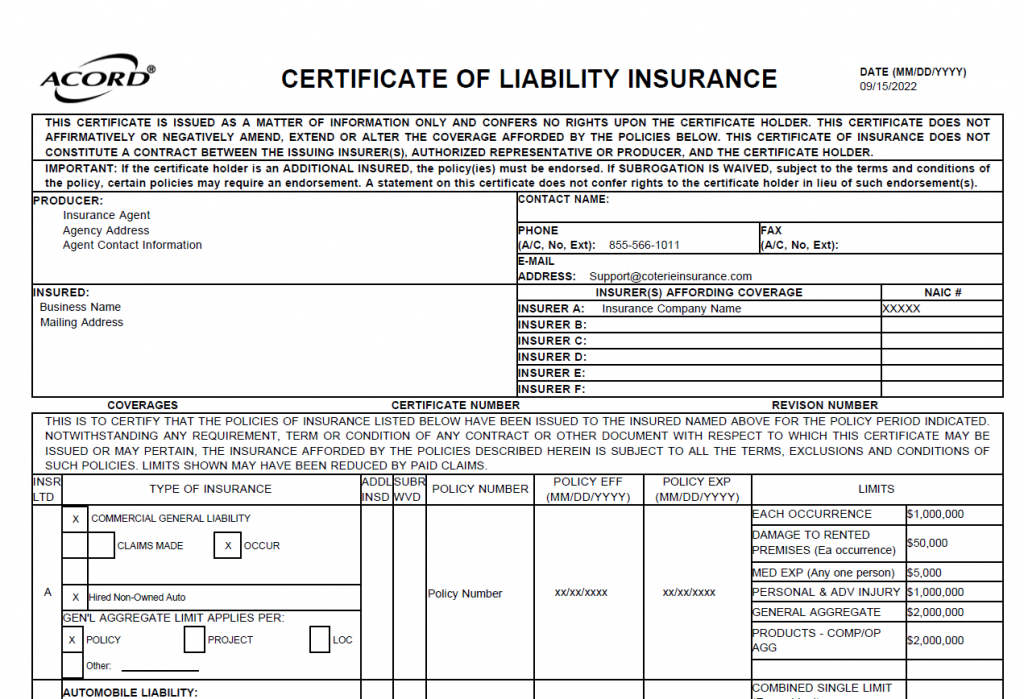

The certificate of insurance is known officially as the Acord 25 form. On the form, you’ll find the listed policyholder name as well as the insurance company that is providing the coverage. The form will also list the coverage you’ve purchased such as general liability insurance, business owner’s policy, workers compensation, and professional liability coverage.

Despite common requests for a certificate of insurance, it’s not a legally binding document. In fact, it functions more like a receipt to show proof of purchase.

However, since policyholders can cancel their coverage after purchase, a COI does not guarantee that the listed policyholder has coverage. The only way to confirm coverage is to call the insurance company directly, and reference the information on the COI.

It’s important to keep an accurate and up-to-date COI. Insurance fraud is a crime.

Why do I as a small business owner need a COI?

You might question why others would want to know you have insurance coverage. Depending on your line of work, such as working on someone’s home, they want to know if you cause damage that they’ll have recourse to be made whole.

Everyone wants to be protected from financial harm, and the COI functions as assurance of this.

What does it mean to be a certificate holder?

A business insurance certificate holder is someone who is listed on the COI. In particular, it means the person wants to keep track of your insurance coverage and ensure they are protected from being held fully responsible.

Certificate holders want to know that you have insurance and it’s kept active throughout the contract, not only in the beginning.

What does a certificate of insurance look like?

What does a COI actually contain?

Your business insurance certificate will have your name listed as the policyholder. Double-check to ensure your name is spelled correctly. If your business is under a LLC, the LLC should be listed as the policyholder. If you’re working under a DBA, your personal name or the DBA should be listed as the policyholder.

Certificate holders and additional insureds will also be listed on the COI. Take time to ensure names and contact information are correct. For a certificate holder to be listed as an additional insured, you must call your insurance company to officially add them. You can confirm this by looking in the description of operations or the “ADDL INSD” box. If you have any questions, please contact your insurance company.

Lastly, verify your coverage is correct. Closely review your policy limits and make sure your policy is active. The policy expiration date should be in the future. Your liability limits and other coverages should meet your certificate holders’ qualifications.

Contact your agent or Coterie to learn more

Your insurance agent or broker is here to help with all of your insurance needs. If you need to find an agent or broker, head to our Find an Agent page.