Contractors are inherently exposed to more risks than you would be as an employee. Without adequate Independent Contractor insurance, mistakes, disasters, and lawsuits could leave you bankrupt and out of business, bringing an end to your livelihood.

1099 contractors are self-employed, which comes with all the benefits and downsides of self-employment. Though you’re free to charge what you want, work with whom you want, and take off time whenever you’d like, you’re also fully responsible for your actions and business — including mistakes, accidents, and acts of nature.

How would you react to an electrical fire inside a building where you installed the conduit? What if allegations arose that you were responsible? What if you filed taxes on behalf of a client, but an error on your part led to them receiving a stiff penalty from the IRS? What would you do if a fire tore through your facility and destroyed all of your expensive equipment?

Accidents and mishaps can lead to costly legal fees, judgments, and settlements, potentially washing away the business you’ve worked so hard to build.

By carrying Independent Contractor insurance, that burden is shifted away from you to provide protection from the everyday dangers and risks that threaten your business.

How does Independent Contractor insurance work?

Independent contractors of any profession need some degree of Independent Contractor insurance. Even if you perform your work with the utmost attention to detail, you may still be held liable for a mistake or momentary lapse of judgment. You may even be the victim of a claim made falsely against you — something you would still have to legally defend against.

After all, independent 1099 contractors don’t need to be millionaires to get sued like millionaires.

Independent Contractor insurance protects contractors and freelancers from being held liable for risks like:

- Bodily injury and death

- Property damage

- Negligence

- Breaches of contract

- Malpractice

- Errors and omissions

- Misrepresentation

- Advertising or reputational injury

- Business interruptions

- Lost income

Consider the nature of your work. For example, an electrician did not properly secure a wire to a newly installed outlet. Over time, the wire comes loose from the receptacle, causing dangerous arcing to occur and leading to a dangerous and destructive house fire.

Even office-based contractors benefit from Independent Contractor insurance. For example, an accountant may give a client faulty advice. If the client acts on that bad advice, the IRS may assess significant fines and penalties upon the client. In turn, the client could file suit against the accountant.

In either of these cases, Independent Contractor insurance would pay for the legal defense and any settlements or judgments made against the contractor, shifting liability away from the contractor and protecting them from costly fees and judgments.

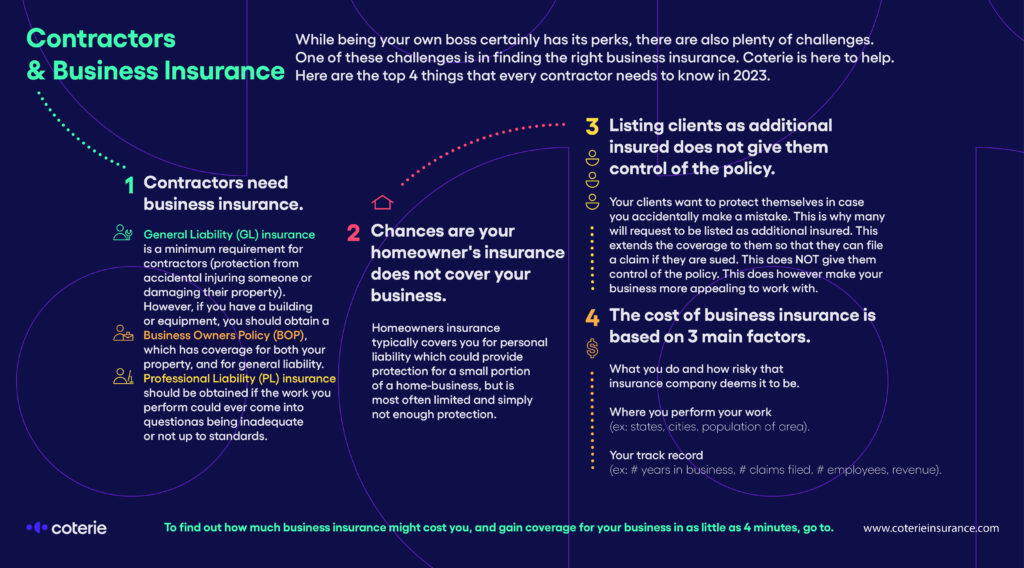

Does homeowners insurance cover your business?

Homeowners insurance provides very limited coverage for some of the risks that threaten an independent contractor.

Usually, homeowners insurance provides up to $2,500 of coverage for business equipment stored within the home. And though homeowners insurance provides personal protection against claims of libel and slander, you may not be covered if the allegation of defamation occurred as part of your profession (so try to refrain from railing against a competitor online).

Homeowners insurance also fails to cover any injuries sustained by your employees, customers, or clients on your property or any damage done by you to another’s property. Additionally, homeowners insurance doesn’t cover loss of income, business interruptions, and business liability (such as claims of negligence or malpractice).

Even in the best of scenarios, homeowners insurance provides insufficient coverage for independent contractors.

Types of Independent Contractors Insurance

Independent Contractor insurance provides a means through which you can protect yourself — and, subsequently, your business — from the risks you’re exposed to.

Independent Contractor insurance is made up of different types of insurance products that work together to provide a cohesive and comprehensive defense against the dangers your business faces. Each component of Independent Contractor insurance is easily tailored to meet the specific needs of your business.

General Liability insurance

General Liability (GL) insurance is the most common form of business insurance. Many states and industries require contractors and small businesses to purchase General Liability insurance. In other cases, customers or clients may require you to hold a General Liability policy before hiring you.

General Liability coverage protects you against claims of:

- Injury or death caused to another person (other than an employee)

- Damage done to a client’s or customer’s property

- Reputational harm (libel and slander)

- Advertising injury (copyright infringement, advertising infringement)

- Invasions of privacy

For example, if a customer tripped over a carpenter’s toolbox, the carpenter’s GL insurance would protect him from any claims. Similarly, if a consultant is accused of defaming a competitor, GL insurance would cover the cost of his or her legal defense and fees.

Business Owners Policy

Business Owners Policies (BOP) provide General Liability coverage in addition to protection for you and your business, including your:

- Building

- Property and building contents

- Lost net income as a result of ceasing or reducing your business operations

- Expenses required to keep your business running following an interruption

- Equipment breakdowns

Because Business Owners Policies are designed to be custom-tailored to the specific needs of an independent contractor, you can elect to purchase additional endorsements, or riders, to protect against the unique risks faced by your business, such as data breaches and water backups.

You may also choose to forego certain types of coverage if it doesn’t apply to your type of contracting. For example, if you’re only renting a building — or don’t work in a building at all — there’s no need to carry building coverage.

Professional Liability insurance

Professional Liability (PL) insurance protects against claims arising from your profession. Depending on your industry, you may be more familiar with the terms “errors and omissions insurance” or “medical malpractice insurance,” each of which is interchangeable with PL insurance.

Professional Liability insurance protects you from being held liable for failing to adhere to your contractual obligations, such as:

- Negligence

- Malpractice

- Errors

- Misrepresentation

- Incomplete or inaccurate work

- Breaches of contract

Generally, if a client files a claim that questions the quality of your work, your Professional Liability coverage would kick in.

For example if a financial advisor provides poor advice that harms his or her client, he or she would be protected by PL insurance.

On the flip side, if an architect designs a building with a fatal design flaw that causes injury to an occupant, the architect would be protected by his or her PL insurance. Though the accident caused bodily injury, it would be a result of professional negligence on behalf of the architect.

NOTE: Coterie does not currently write Professional Liability Insurance for artisan contractor trades like electricians, plumbers, painters, HVAC, and so on.

Who needs to buy Independent Contractor insurance?

No contractor wants to produce poor work, neglect a contract’s terms, or make a mistake, but these events happen all the same and aren’t always easy to prepare or plan for. As a 1099 contractor, it’s your responsibility to protect yourself and your business.

The only way to protect against the unexpected is with Independent Contractor insurance. Insurance coverage affords you peace of mind in the knowledge that you’re protected from your day-to-day risks.

Because Independent Contractor insurance is so versatile, policies may be tailored to protect any type of 1099 contractor.

Carrying Independent Contractor insurance enhances the marketability of your business, too. In fact, some clients require you to list them as “additional insureds” on your policy before working with you.

But don’t worry: Additional insureds don’t have any control over your insurance. By listing a customer or client as an additional insured, you’re simply extending your policy’s coverage — not control — to them.

This means that if a client’s sued because of work you’ve done on their behalf, they can file a claim under your policy and enjoy the same protections. However, additional insureds cannot alter, cancel, or otherwise manage your policy; they simply share your peace of mind.

What does Independent Contractor insurance cost?

Insurance is a method of sharing risk amongst a group of similar entities — in this case, contractors. An important part of calculating insurance premiums, or rates, is a process called classification, which insurers use to group and organize businesses together, splitting risks among them.

During classification, insurers consider:

- What you do and how risky it is

- The size of your business (both employees and client/customer base)

- Where you do your work (city, state, population size)

- Your track record (how long you’ve been in business, number of claims filed, revenue)

- Type of certifications and training

- How long you have been professionally licensed and/or practicing

Together, these questions help to group your business into a category with similar businesses. For example, a solo plumber who only services residential properties is exposed to a certain set of risk factors compared to a commercial plumber who services factories. And plumbers, in general, are exposed to different risks than electricians, accountants, or doctors.

The cost of Independent Contractor insurance further depends on the specific coverage you purchase, as well as your coverage limits (the maximum amount of money your insurer will pay out to cover a claim).

For example, a plumber will likely pay a higher premium for General Liability insurance than an accountant would because the plumber has a greater chance of injuring a customer or damaging their property and needs higher GL limits.

On the flip side, accountants are more exposed to risks stemming from errors and omissions, so would pay more for Professional Liability insurance than a plumber would.

The ultimate goal of Independent Contractor insurance is to pay a little money upfront — your premium — compared to upwards of millions of dollars unexpectedly. By splitting the risk amongst like contractors, you’re able to plan and budget for your protection against litigation and claims.

How to buy Independent Contractor Insurance

Independent Contractor insurance is a necessity for any 1099 contractor. Without adequate coverage, a mistake or unexpected event may cost you, your business, or your customers potentially millions in litigation, judgments, and settlements, severely jeopardizing your ability to remain in business.

Fortunately, Independent Contractor insurance can be purchased in as little as four minutes through a trusted insurance agent working with Coterie Insurance. After obtaining some basic information about your business, industry, and needs, your agent will provide you with a Coterie quote for Independent Contractor insurance.

From there, you can enjoy the peace of mind of knowing that you’re protected from whatever risks threaten your business and hard work.